Top Forex Reversal Patterns that Every Trader Should Know Forex

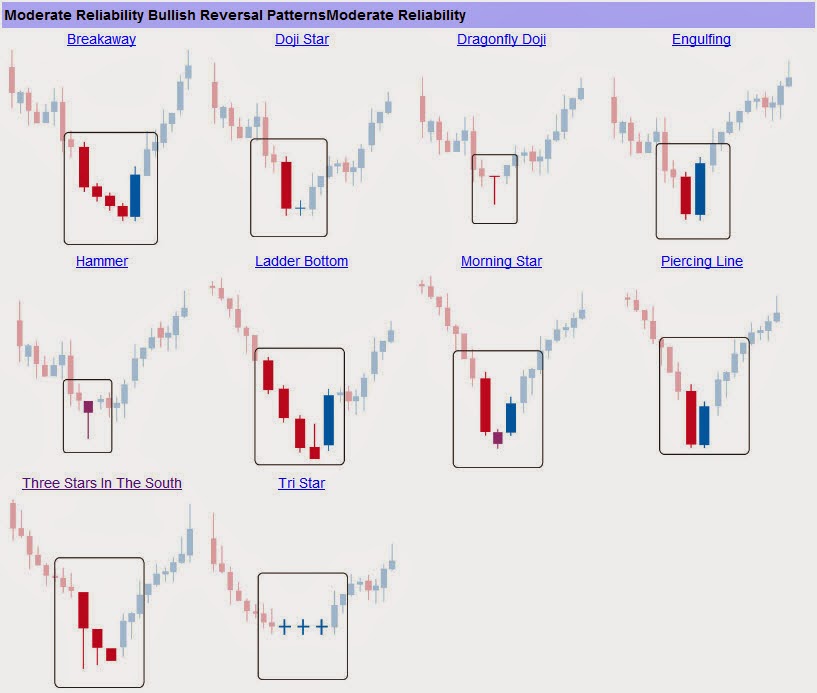

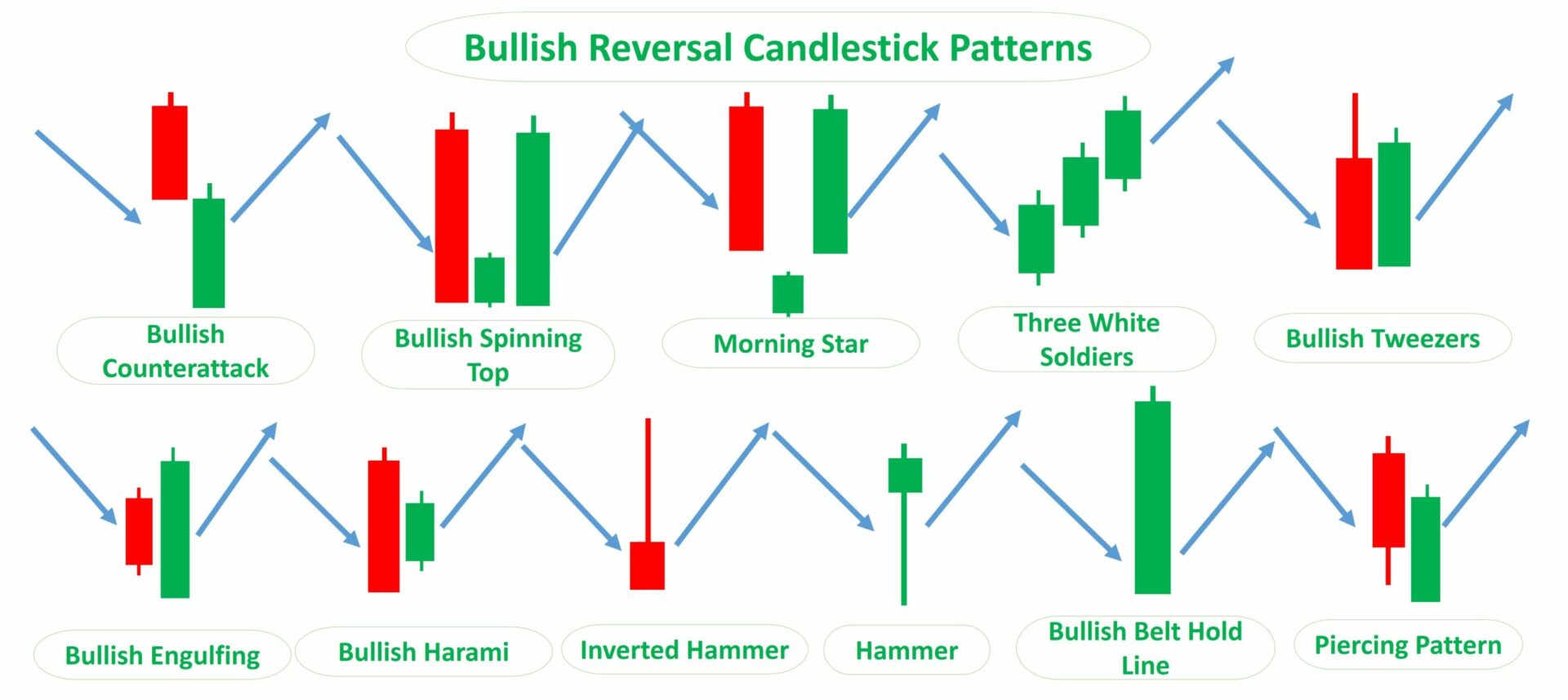

A bullish reversal candlestick pattern signals a potential change from a downtrend to an uptrend. It's a hint that the market's sentiment might be shifting from selling to buying. Important Bullish Reversal Candlestick Patterns to Know There are dozens of bullish reversal candlestick patterns.

Bullish Hikkake Pattern How To Beat the Market Alphaex Capital

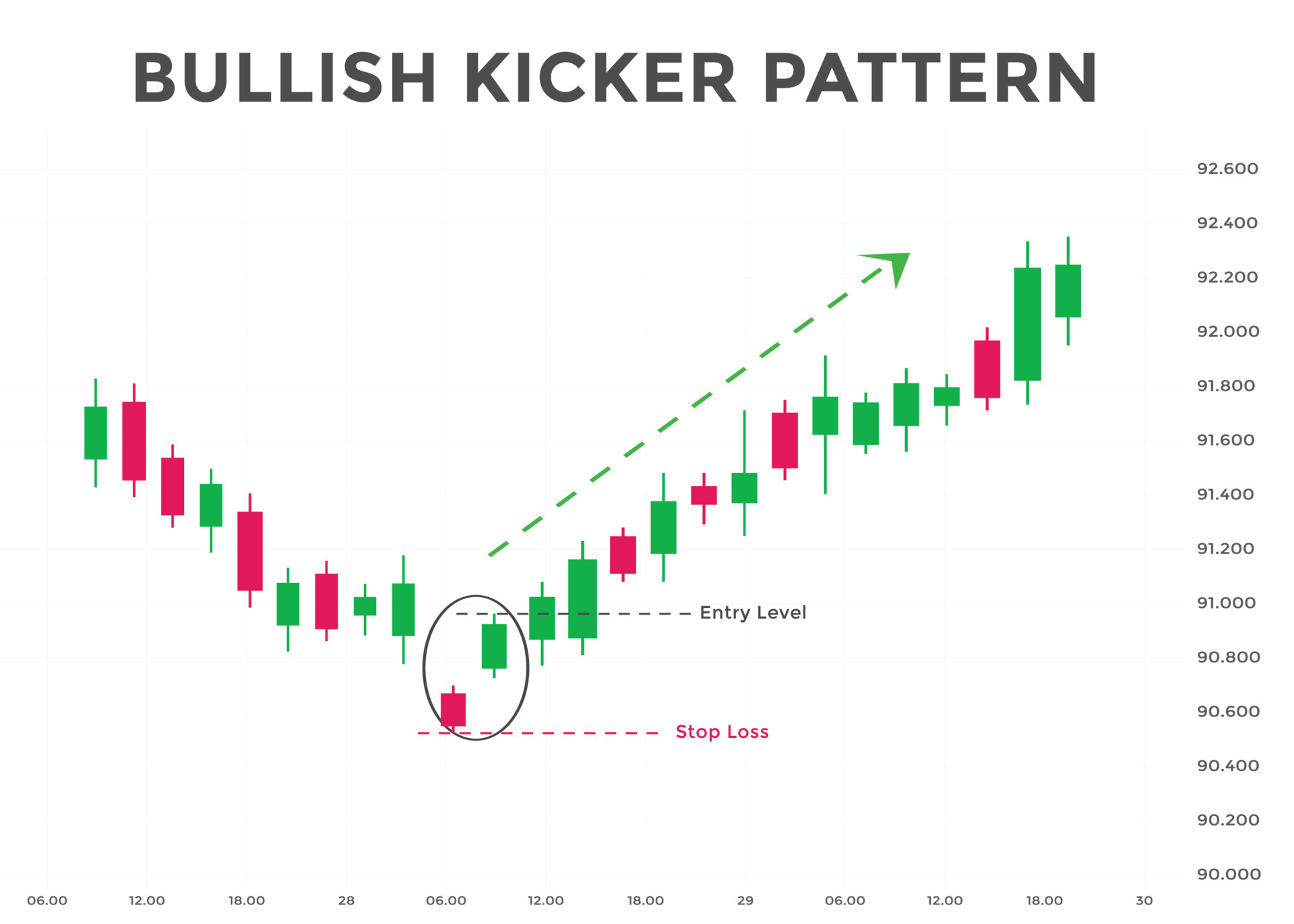

For the bullish pattern, enter long after the gap and move in the opposite direction. Exit: An exit refers to both the target and stop-loss . With this pattern, you want to capture the thrust.

Forex Master Class Candlestick Reversal Patterns

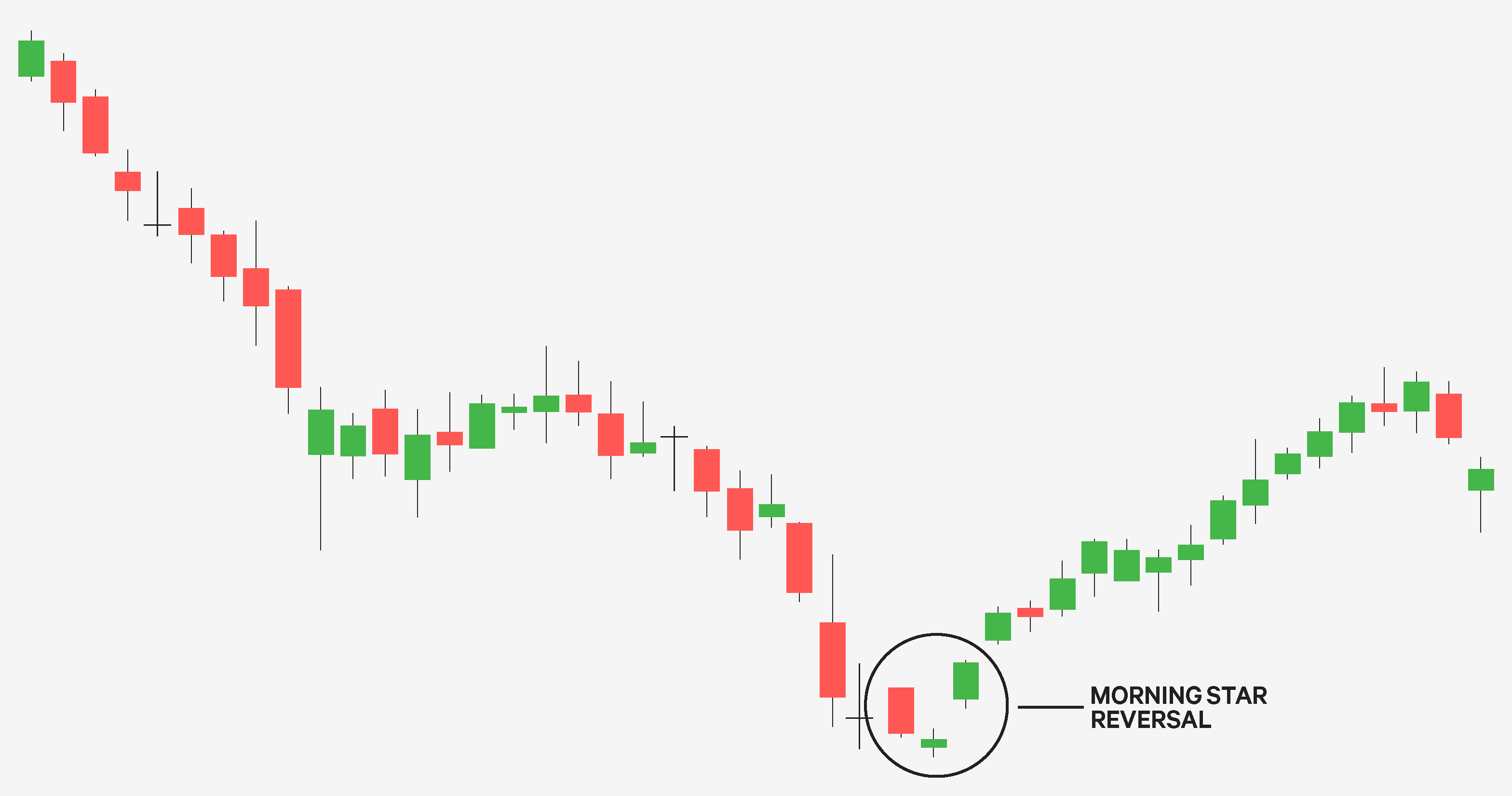

A candlestick reversal pattern is a series of one to three candlesticks in a specific order. And when you learn to spot them on charts, they can signal a potential change in trend direction. This is when momentum begins to shift. The shift can be either bullish or bearish. Candle Graph Explained: How Does It Work?

Five Powerful Patterns Every Trader Must know Video and Examples

Bullish reversal candlestick patterns make it possible to predict trends and market change. They help to spot price reversal as well as identify sellers losing their positions. The main challenge about bullish candlesticks and signals they provide is the necessity of proper confirmation. This is where traders may need a variety of extra tools.

25 Bullish reversal candlestick pattern every trader must know and how

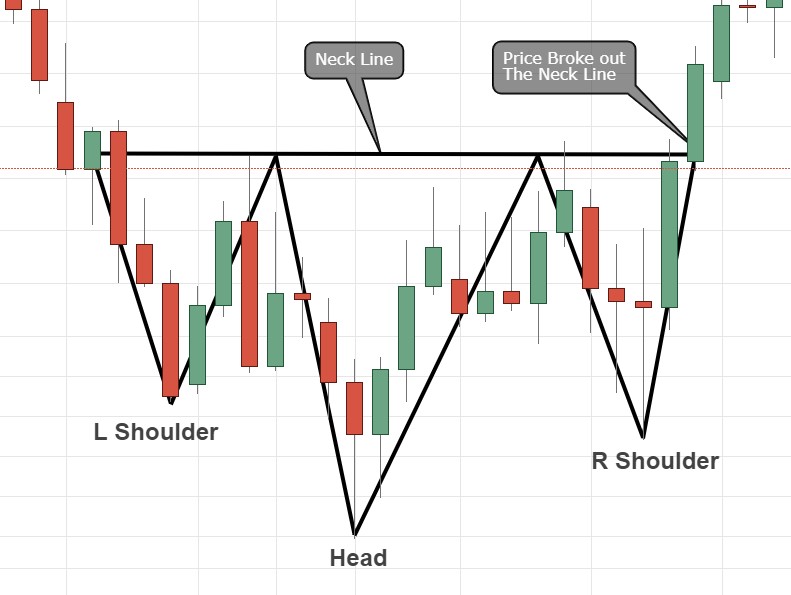

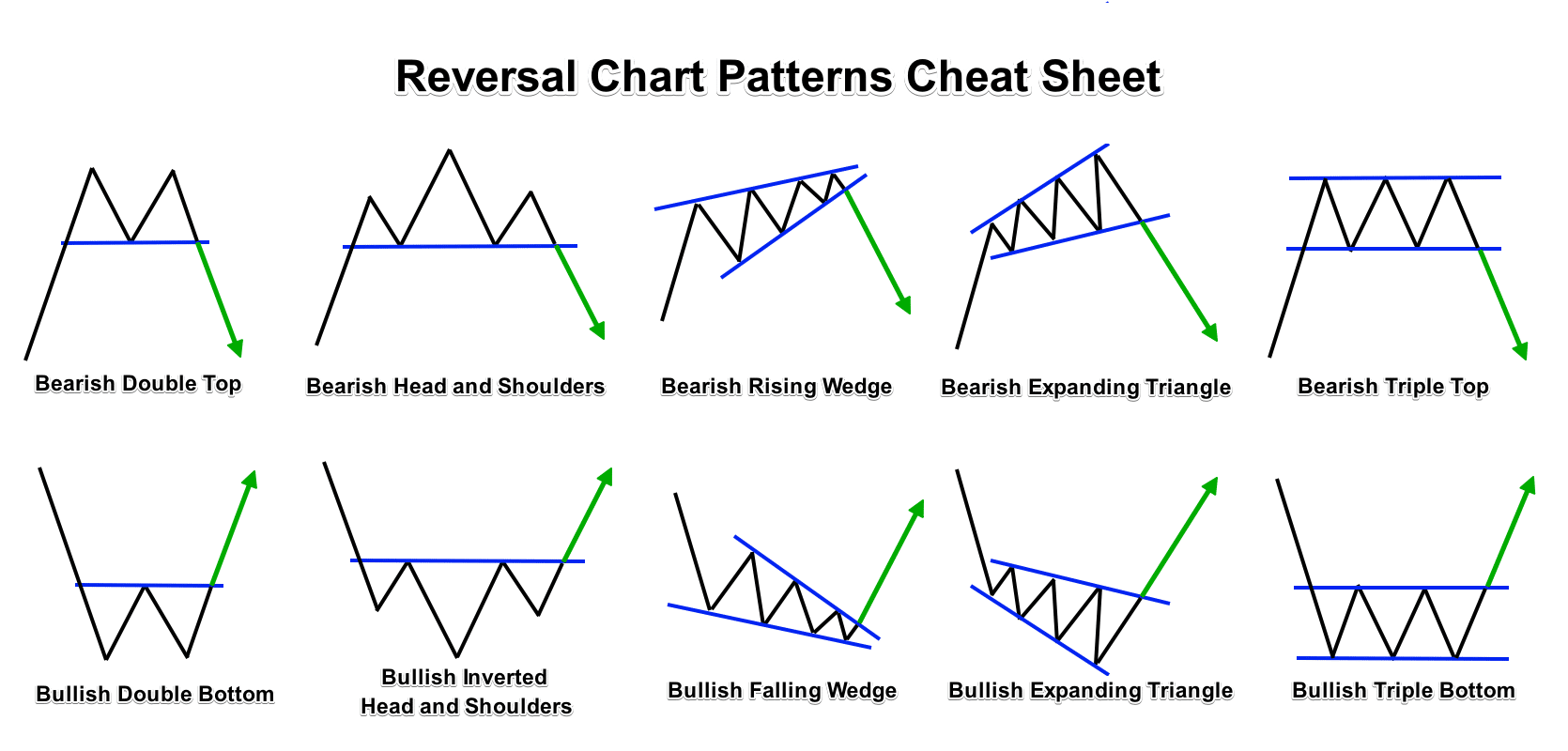

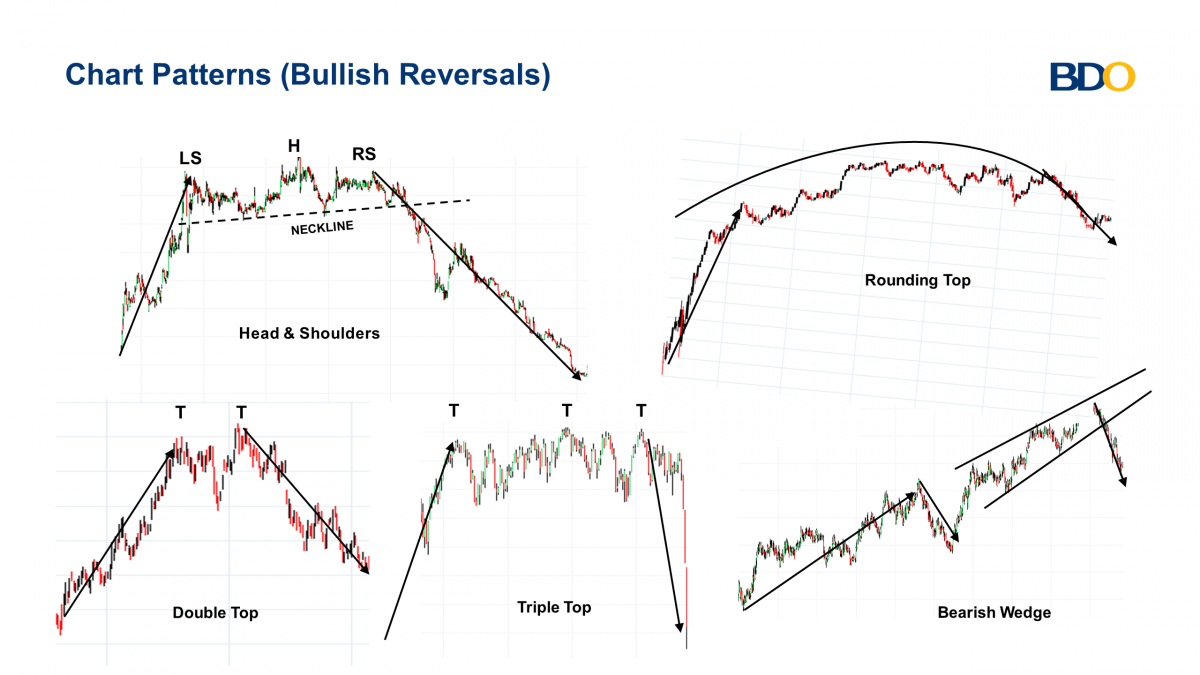

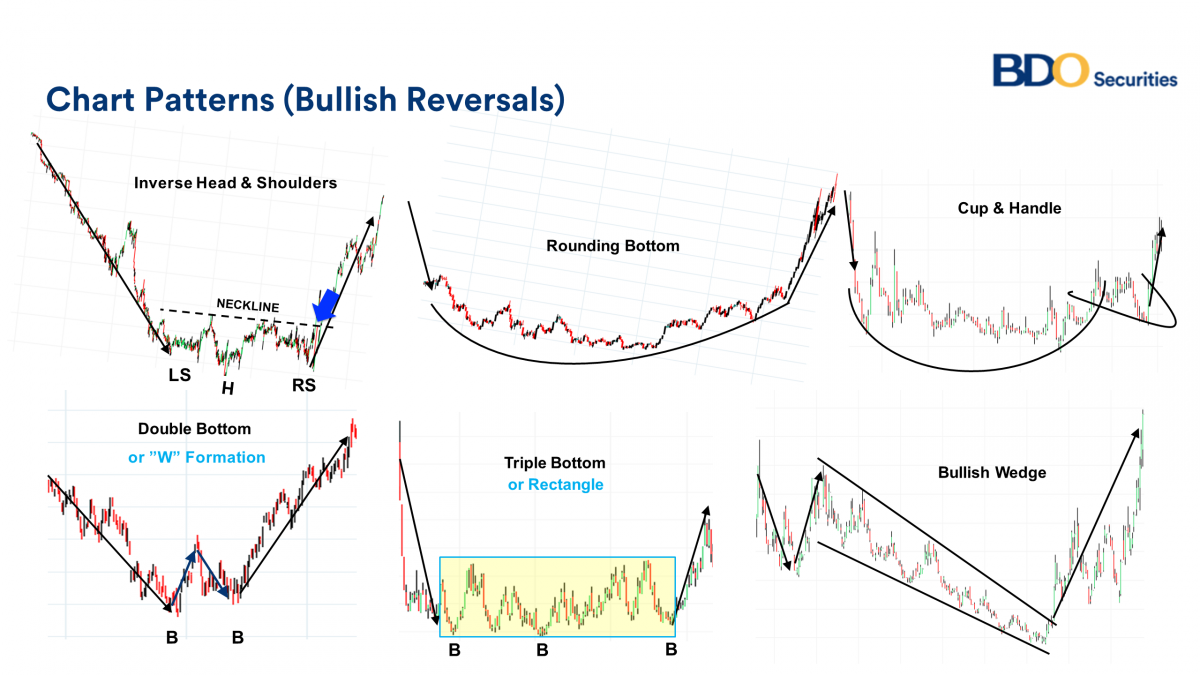

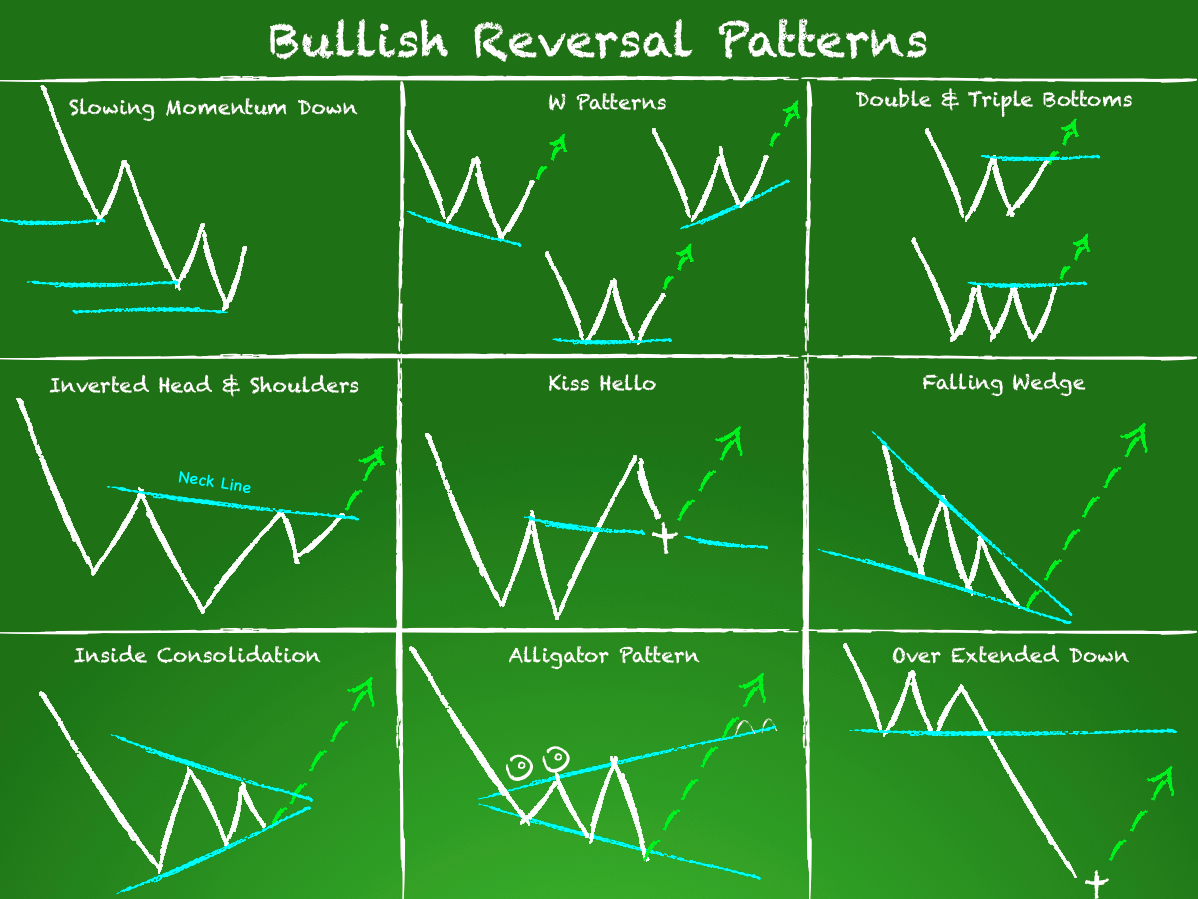

A chart pattern (or price pattern) is an identifiable movement in the price on a chart that uses a series of curves or trendlines. These patterns may repeat and occur naturally due to price action, and when they can be identified by market analysts and traders, they can provide an edge to trading strategies and help them beat the market.

Top Reversal Candlestick Patterns

1- Bullish reversal patterns should form within a downtrend. Otherwise, it's not a bullish pattern, but a continuation pattern. 2- Most bullish reversal patterns require bullish confirmation.

Reversal Forex Chart Patterns Cheat Sheet ForexBoat Trading Academy

Bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. This shows buying pressure stepped in and reversed the downtrend. Some examples of bullish candles are the Hammer, Inverted Hammer, and Bullish Engulfing patterns.

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

For example, a bullish reversal pattern will typically happen during a downward trend and lead to a new bullish trend. These patterns can help you make better decisions about when to enter a trade. In this article, we will look at the best reversal patterns - classical and candlesticks - to use. » Related Contents

Bearish & Bullish Reversals BDO Unibank, Inc.

Inverse Hammer/ Shooting Star Reversal Pattern. Much like the Hammer pattern for bullish reversals, the Inverse Hammer is a single candlestick reversal pattern used to identify potential bearish reversals. Here's how it typically unfolds: Price needs to rise to a specific area of value and treat it as resistance.

Trading Forex With Reversal Candlestick Patterns » Best Forex Brokers

Bullish Reversal A Guide On Bullish Reversal Patterns At CAPEX.com A crucial skill for every trader to learn is to spot the reversal - the moment the price halts and starts going the other way. At CAPEX, we provide traders with all the tools to analyse the markets and identify the bullish reversal.

Bullish kicker candlestick chart pattern. Candlestick chart Pattern For

These Candles also work as reversal candles. That's why we can also call them bullish reversal candlestick patterns. If these candles are formed in an ongoing downtrend, the trend will change from down to up. So, traders should be cautious about their selling positions when a bullish reversal pattern appears. 7 Bullish Candlestick Patterns

bullishreversalcandlestickpatternsforexsignals daytrading

The Dragonfly is the bullish reversal pattern showing buyer supremacy, whereas the Gravestone Doji is a bearish reversal pattern where sellers prevail. Here is a gravestone Doji formation corresponding to the ETH.D monthly chart, showing that ETH dominance might drop over time. Belt Hold bearish reversal candlestick pattern: TradingView

Bearish & Bullish Reversals BDO Unibank, Inc.

Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. Hammer A 1-candle pattern. It can signal an end of the bearish trend, a bottom or a support level. The candle has a long lower shadow, which should be at least twice the length of the real body.

What Is A Bullish Reversal Pattern Candle Stick Trading Pattern

Bullish reversals are likely to resolve in an up-trend; and. Bearish reversals are likely to resolve in a down-trend. Candlestick pattern strength is described as either strong, reliable, or weak. Strong candlestick patterns are at least 3 times as likely to resolve in the indicated direction. Reliable patterns at least 2 times as likely.

Are Chart Patterns Reliable? Tackle Trading

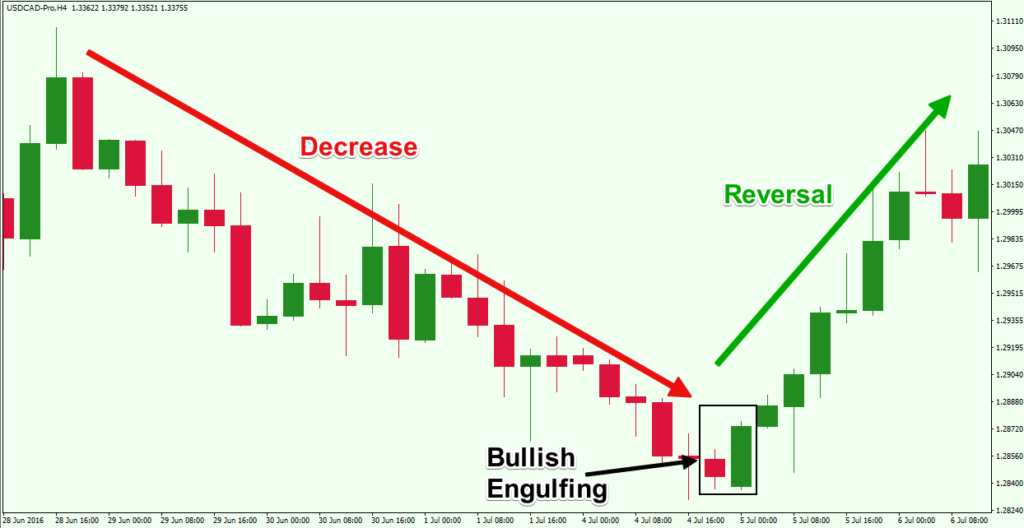

This pattern often signals a reversal from a downtrend to an uptrend — the larger green candle indicates that bullish sentiment has become dominant in the market. This pattern is most useful for finding the exact moment when a reversal has already started — or in other words, it gives you confirmation of a reversal. 2.

Bullish Reversal Patterns Doji Thinkorswim Switching Tickers Defensa

1 Introduction 2 What is Candlestick reversal pattern? 3 What are reversal patterns? 4 Reversal candlestick patterns 4.1 Candlestick bullish reversal patterns 4.1.1 Hammer 4.1.2 Morning star 4.1.3 Morning Doji Star 4.1.4 Inverted hammer 4.1.5 Piercing line 4.1.6 Bullish harami 4.1.7 Bullish Harami Cross 4.1.8 Bullish engulfing pattern